Alternative Credit Data

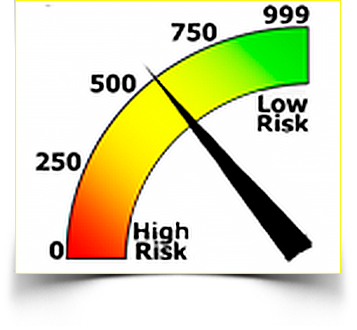

CBC’s eClear Credit Risk Report is an “alternative credit data” credit report that is designed primarily for buy-here-pay-here dealers and automotive lenders in the sub-prime space. Powered by Clarity Services’ extensive consumer database, you can now receive valuable insight into the credit worthiness and risk level of your buyers based on alternative data not delivered with traditional credit reports. This enhanced consumer assessment will allow BHPH, independent dealers, and lenders to recognize potential risk prior to contracting a high-risk, bad payer.

In a world that is more data-driven than ever and a factor in driving this momentum can be best explained by a finding from an Experian survey: “70% of consumers are willing to provide additional financial information to a lender if it increases their chance for approval or improves their interest rate for a loan”.

This “additional financial information” is what we mean when we say alternative credit data. This generally includes data that is not found in a traditional credit report. This can include, but is not limited to, alternative financial services data, rental data, full-file public records, and account aggregation. Alternative credit data has already become a staple because it allows for better decisioning when determining credit worthiness.

Do you offer in-house financing? Then CBC’s eClear Credit Risk Report is the ideal solution for you. CBC’s eClear Credit Risk Report provides valuable insights into credit worthiness and risk and is powered by Clarity Services.

HIGHLIGHTS

The Ideal Solution for Buy-Here-Pay-Here Dealers

Provide critical insights into a consumer’s stability, ability, and willingness to repay, that is not available on a traditional credit report.

Supply Non-Traditional Data to Subprime Lenders

Improve and speed up decisioning by having this additional data available to enhance your lending decision process.

Payday Loan, Cell Phone, Utility Payment Data, and More

Reliable data that can mean the difference between funding and not funding a questionable buyer or assisting with processing no-file or thin-file traditional credit data applicants