Here is a quick explanation of the difference between PreQualification credit report and PreScreen offers of credit.

Prequalification:

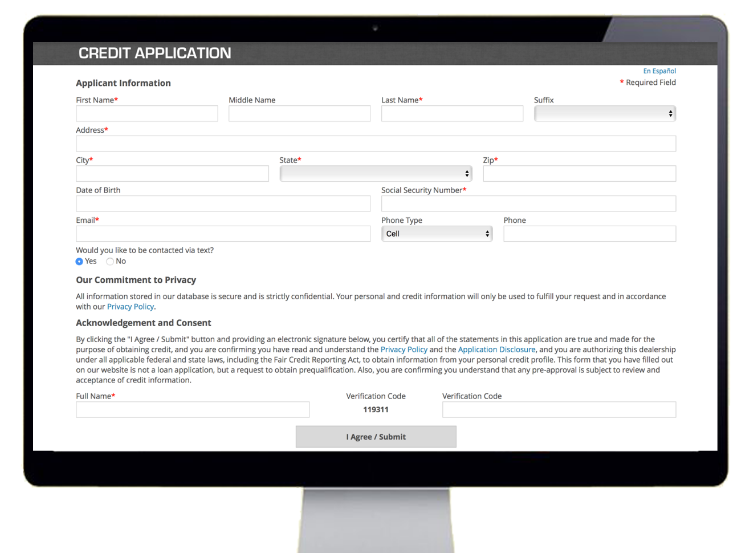

- Consumer initiates the prequal process by submitting a signed consumer consent prequal application

- Subscriber receives a full-file credit report and FICO score

- Subscriber DOES NOT provide credit score to consumer therefore is not required to deliver or mail RBPN

- Subscriber returns a prequalified or not-prequalified response to the consumer

- Subscriber is under no obligation to conduct business with consumer

- Minimum required age = 18

Prescreen:

- Prescreen process is initiated by the subscriber via mail campaign, in-house, or phone campaign

- Subscriber provides bureau(s) approved lender based credit offer

- “Pre-approved firm offer of credit” must accompany pre-approval offer if the applicant meets pre-determined criteria

- Subscriber receives report summary with score or score range

- Firm offer must be handed to consumer in person or mailed first class

- Minimum required age = 21

Although both processes have a viable use in the credit report process and are soft pull credit reports not effecting the consumers FICO score or count as an inquiry, CBC recommends a prequalification process to begin the customer journey either online or in-house. Contact sales@creditbureauconnection for a more in-depth explanation or click here to schedule a demo.